Gen Z: Reshaping the Financial Services Landscape

June 13, 2022

It’s a classic coming-of-age story. Generation Z—those born between 1997 and 2005—are shaking things up as they enter adulthood, exerting strong influence over lifestyle, work, and consumer trends.

Gen Z currently earns $7 trillion across its 2.5-billion-person population, according to a recent study*. By 2025, that will grow to $17 trillion. With rapidly increasing wealth come greater spending power and a greater need for financial advice. In many ways, these consumers will dictate the future of banking in Canada.

So what, exactly, will that look like? To answer questions like this, DCM commissioned the 2022 Canadian Banking Satisfaction & Engagement Survey. Through a panel methodology, we surveyed 3,166 Canadians (323 of whom were members of Gen Z) who identified as the primary financial decision maker in their household. The goal? To get a better sense of how they interact with banks today, and what they will be looking for tomorrow.

|

We’ve summarized the findings into five key trends: |

*Bank of America Global Research, OK Zoomer: Gen Z Primer. December 2020.

![]()

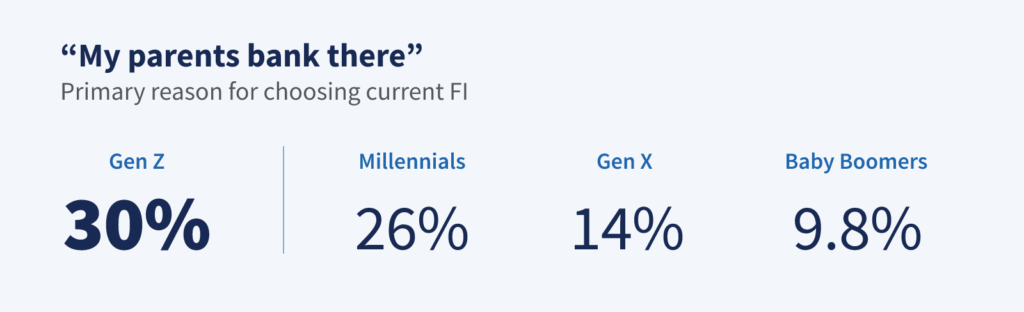

The “First Interaction” Advantage

As with most things in their lives, Generation Z exudes confidence about consuming and saving. Their financial literacy is generally well ahead of where previous generations were at their age. Yet current Gen Z behaviour remains cautious, likely shaped by the significant financial hit of the COVID-19 pandemic.

This sets up the first interesting finding from our survey: 30% of Gen Z respondents—more than any other generation—identified “my parents bank there” as the primary reason why they chose their current primary financial institution. This compared to Baby Boomers (9.8%), Gen X (14%), and Millennials (26%). Moreover, this motivator easily trumped things like rates and fees (19%), convenient locations (12%), personal recommendations (11%), and products/services (7%).

The results suggest big banks have a significant advantage: First dibs on interacting with Gen Z customers. However, given the demographic’s insatiable appetite for online information, banks would be wise not to take this first interaction for granted. If presented with alternatives that fit their spending and saving habits, Gen Zs will jump ship. New initiatives and offerings that reflect the progressive, yet prudent approach of Gen Z would build on the early advantage.

Lack of Loyalty: Opportunity Knocks

Eight seconds*. That’s the attention span of Gen Z today, down from 12 seconds just a decade ago. It’s only natural that this generation is less loyal to pretty much anything, including their financial providers.

25% of Baby Boomers, 15% of Gen X and 10% of Millennial respondents claimed they would not be motivated enough to switch their banking provider even if an alternative offered benefits like better rates and fees, better products and services, better locations and hours, or came recommended from a friend. Only 6% of Gen Z said the same. What does that tell us? If these consumers are met with the right offering and experience, they will make the switch—more so than any generation before.

Each generation changes the rules of the game. The financial services landscape is evolving fast, driven by an accelerating pace of new product and service introductions. Eager adopters of disruptive alternatives such as cryptocurrencies, peer-to-peer sharing, and more, Gen Z is more accepting of fintech, open banking, and other alternatives. Financial entities that adapt to these preferences and possibilities will be best positioned to earn their attention and potential business.

*5 Differences Between Marketing To Millennials Vs. Gen Z, Forbes Magazine, 2017.

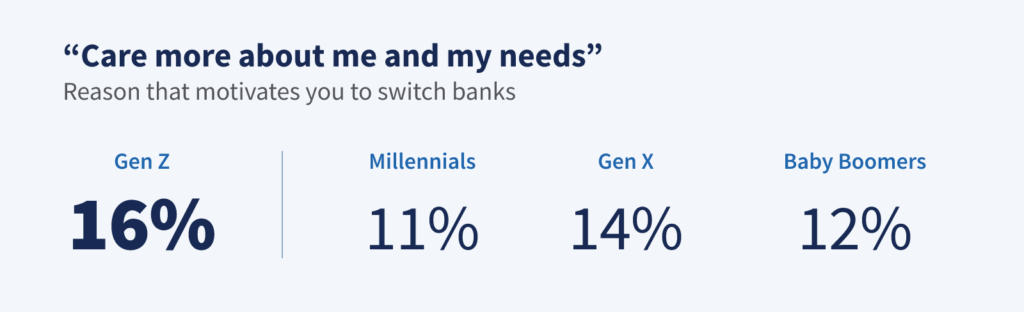

Get Personal to Get Attention

Digital media has made access to financial information easier for everyone. What used to be reserved for the privileged is now abundantly available to all—especially the tech-savvy members of Generation Z.

But while you can find anything you want about a financial plan on Google, it’s still just a search engine. This brings us to our next intriguing survey finding. Despite a strong affinity for digital and tech, 16% of Gen Z members would switch banks if they “care more about me and my needs”, placing greater importance on this fact than Millennials (11%), Gen X (14%), and Baby Boomers (12%). What’s more, a surprising 15% of Gen Z respondents said “a better customer experience” would lead them to swap providers.

|

Learn how one financial institution has made marketing simpler, more compliant, and more customized. |

What kind of experience, exactly?

Generation Z tends to prioritize needs over products. They want to learn new options for managing their finances and want more personalized products to match. They want to feel like their bank truly understands them and their unique needs. A balance between digital functionality and personalization hits the sweet spot.

Technology vs. the Human Touch

Are traditional banking tools becoming obsolete in the eyes of Gen Z? At first glance, you might think so. Just 43% of Gen Z of members in our survey used a bank machine over the past year. Only 31% had used a bank teller, a percentage lower than all other generations.

Yet there’s a surprising revelation that suggests Gen Z still places value on the very tool the industry seems to be moving away from—in-person interaction and advice. According to our survey, 20.6% of Gen Z members consulted a financial advisor via an in-person branch visit over the last year, a frequency that’s virtually identical to Millennials (20.4%) and Gen X (19.8%).

|

Generation Z may be more comfortable using technology for everyday transactions, but they still value in-person advice when making big decisions. |

While strategies emphasizing less human contact are “innovations du jour”, financial institutions that optimize seamless experiences across digital and in-person elements—including opportunities for face-to-face assistance when desired—will strike a chord with Gen Z.

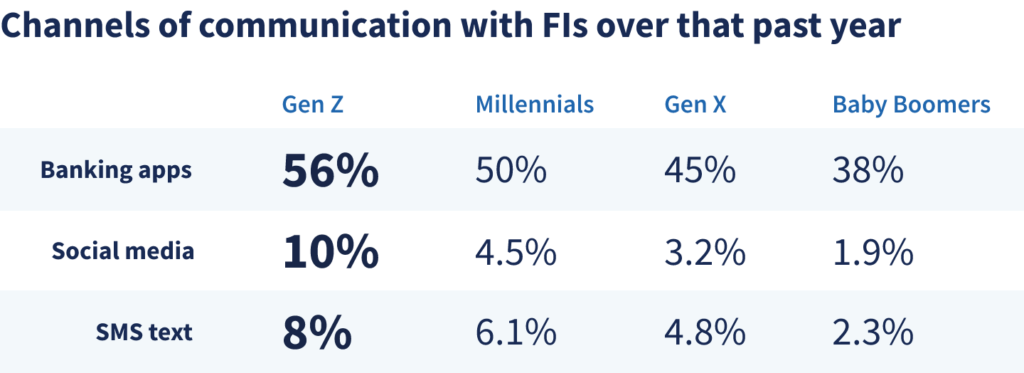

The Digital Dichotomy

Given Generation Z’s comfort with digital and social networks, they are understandably focused on having bank services that fit around their lives, not vice-versa. They expect flexibility, transparency, and 24/7 digital services.

Unsurprisingly, 56% of Gen Z members embrace banking apps more than Millennials (50%), Gen X (45%), and Boomers (38%). What’s more, Gen Z respondents showed a higher propensity to use social media (10%) to communicate with their bank than Boomers (1.9%), Gen X (3.2%), or Millennials (4.5%). In a similar vein, Gen Z also led the way in using SMS text (8%) over other generations: Boomers (2.3%), Gen X (4.8%), and Millennials (6.1%).

The ability to pay on the go, send money to friends, and seamlessly pay online or in-person is largely ubiquitous across financial services. Yet as our “Tech vs the Human Touch” trend indicates, simply adding digital features to legacy platforms will not likely be enough to win over Gen Z customers. While they expect digital convenience, they still value authentic relationships that go beyond the applications themselves.

Leverage What You’ve Learned

Information rich. Attention starved. Digital multi-taskers. Craving instant gratification, yet appreciative of personalized, face-to-face interactions. Fascinating bunch, these Gen Z folks.

There’s little doubt that they are reshaping banking. Raised in the shadow of the 2008 depression, impacted by the COVID-19 pandemic, and fortified by digital media, they view and interact with financial entities in surprising new ways.

To lead and grow, financial entities must rise to the challenge of engaging with these younger, massively influential consumers in ways that are relevant to their needs. Our key findings and takeaways provide critical insight on how to make lasting connections with Gen Z.

|

Initially, Gen Z often chooses the same financial partner as their parents. Given this “first touchpoint” advantage, big banks have a golden opportunity to demonstrate to Gen Z that they understand and care about their specific needs. This can include developing new products and services that leverage Gen Z knowledge and outward confidence about money, while also focus on creating a holistic financial services experience.

|

|

|

Gen Z consumers are less loyal, more open to switching financial providers. Gen Z grew up in a digital age of instant gratification and possess a fractured attention span. Traditional customer retention strategies have far less impact on them than previous generations. Gen Z are eager adopters of disruptive alternatives, so financial entities that adapt will be best positioned to capture their attention and retain their business.

|

|

|

Gen Z wants an experience focused on care and understanding…or they’ll switch. Generation Z tends to select and interact with providers that have similar values to them and truly appreciate their business. They want to feel like their bank understands them and provides offerings that meet their specific, yet evolving needs. Digital functionality matters, but not at the expense of personalization.

|

|

|

Gen Z still values in-person advice when making big decisions. Technology is only part of the value equation for younger customers. It’s expected for day-to-day transactions, but bigger decisions call for face-to-face assistance. For Gen Z, optimization of experiences across digital and in-person is the right approach.

|

|

|

Gen Z craves integrated, seamless channels of communication. Gen Z expects bank products and services to fit around their lives, not vice-versa. Financial entities must communicate with Gen Z when and where they want. While 24/7 digital convenience is valued, so too are authentic relationships that go beyond the app. |

|

Want to learn more about how DCM supports Canada’s largest financial institutions?Find out more at Financial services

|